Lottery vs. LTC – which will you choose?

Recently, KIRC proposed a question to followers: “What item(s) do you wish you had understood more about at the beginning of your caregiving journey?”

One of the overwhelming answers had to do with finances and how to plan for paying for eldercare. Specifically, long term care insurance or LTC.

Elder care is expensive. In-home care can costs hundreds of dollars a day. Facility care can range from 3-8 thousand dollars a month; sometimes even more.

I don’t know about you, but I don’t know many people who have that kind of cash sitting around. Unless of course, they have managed to figure out the winning lotto numbers week after week. (For fun – sure. But this is NOT an investment strategy I would recommend)

So how do we figure out how to come up with such funds? I reached out to a financial planner and life insurance expert to offer some ‘must know’ nuggets.

In full disclosure, she is a friend and long-time trusted colleague.

Like myself, Vickie Frazier-Williams is a former broadcast journalist who after many years of tracking down information and stories in the news biz, changed careers.

She now helps folks map out how to get the most out of their hard-earned income as a financial planner with emphasis in insurance. She admits the bulk of her business is focused on women and their families.

I caught up with Vickie to dive into what we need to know about LTC. There is so much to unpack in this topic, this will be a two-part interview

LTC: What you need to know

Q: Why is it so important for women to pay extra attention to insurance and planning for aging?

A: We tend to take care of everybody and everything else and a lot of times the things we need to focus on and know about become secondary.

In the early years of me working in television [and you know this] we had great benefits and salaries. But using those salaries and those benefits in the best possible way… there was really nobody showing us how to do that.

So that’s at the heart of what I do: life insurance, long term care and investments. And all of it with the understanding of what women need and want and where their financial goals are.

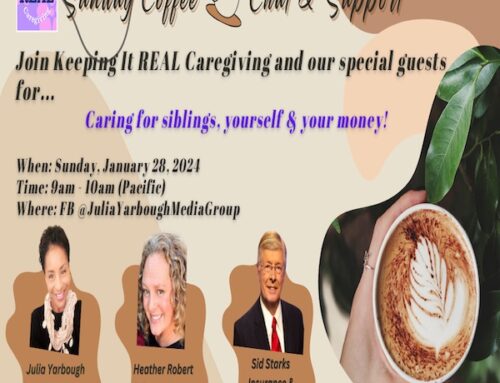

Vickie Frazier-Williams/Financial Literacy Expert & Julia Yarbough/KIRC

Q: When we look ahead to taking care of our elders or ourselves, what do we absolutely need to think about?

A: The most important thing is to educate yourself. It is really important to know what you have in place and what you don’t have in place. Ask yourself, what is important for when you are either no longer working or no longer able to take care of yourself? When you are no longer able to make certain decisions for yourself? Those are critical things to have in place.

Types of insurance

If you have insurance you need to know:

What kind of life insurance do you have?

What is the role of that cost and what is it going to do for you?

How long is it going last?

And you have make sure of the kind of company you are working with. Life insurance is intended to be a long term thing. It is supposed to last through the generations. So paying attention to the paying power of the company you are investing in is important.

Q: Why is this crucial for women?

A: Life insurance is designed to focus on us living longer. Statistically we are going to need some form of extended care help.

You need to have a plan. You need to be thinking about, ‘What is it I may have to be dealing with?’ So what items should you be thinking about?

A long term care plan is a good thing to have.

What about a living will?

A healthcare surrogate?

What do I mean? Well, It means if I get to a place where I am unable to make decisions about the kind of care I am having or want, I need to have already designated someone who I trust and love and who I believe in, and who loves me… to take care of those things.

And we cannot rely on verbally knowing these things or simply telling someone that. All of this needs to be written down in black and white.

Q: Long Term Care insurance can be confusing. What are the key items you would advise we all know?

A: The first problem is that most people think LTC is something Medicare will take care of. The fact of the matter is it doesn’t.

Medicare may take care of a few days [of care or rehabilitation] and there are all kinds of conditions that may have to be met first.

So the first thing to understand is LTC is not coming from Medicare and it is not coming from Social Security.

LTC is a totally separate bucket of money that is reserved specifically for your care for an extended period of time (private savings or investments).

Courtesy: Getty Images/FG Trade

Breaking down LTC

Q: Vickie, you say we should tackle LTC just like journalists asking questions… focusing on the who, what, where, when, why and how?

A: Yes. Ask yourself:

WHO will take care of you if you can’t take care of yourself? You have to ask the question and it’s not easy.

Some people will say, ‘Well I have children.’ God Bless you if you have children who will in some cases leave their lives to care for you. You are blessed if that’s the case. But what about if that does not exist?

The other part of that equation is: do you WANT your children to have to leave their lives to take care of you? And most parents will say, I don’t want that.

The next question is WHERE. Where will that care take place? In your home? A nursing home? You need to plan for that. I call financial planning the nursing home avoidance plan.

The next question is HOW. How are you going to pay for care?

Depending on what state and what facility, a daily rate could go $250 or higher. Failing to have care dollars set aside means your ability to choose what kind of facility you can consider is taken away from you.

But if you have LTC sitting aside, you have some control over where you’ll be taken care of, how well you will be taken care of and frankly when and how long.

****************************************

REAL experience

My personal experience with long term care insurance was love/hate. As my mother, Miss Nellie aged and her health declined, I was beyond thankful I had the wherewithal to have purchased an LTC policy years prior.

It had a daily benefit payout of $89 in coverage. That’s not a LOT when hourly care can be as high as $30/hour. But it allowed me to have some in-home care when the going got tough.

If I had understood the difference in types of care and how expensive each can be, I probably would have purchased a different plan. But something was better than nothing!

This is why I started Keeping it REAL Caregiving. To delve into the ‘you don’t know what you don’t know’ areas. Be sure to SUBSCRIBE to stay in the mix and join the discussion…

Without that insurance benefit, I probably would have had to quit work to care for my mother. And in her final year, it would have been financially impossible to have turned to facility care once her needs became 24/7.

KIRC has much more with advisor Vickie Frazier-Williams in our next update. While you digest all of this information, here’s something she wants you to keep in mind:

“Some people say LTC is too expensive and say, ‘What if I never use it?’ Well guess what? You have to have car insurance and may never use that either. It is better to have it than not.”

I could not agree more. Until next time…

Ciao~

Like our content? We invite you to leave a comment and say hello!